The Role of Big Data in Fintech

Use Cases of Data Science in Fintech

How Can Big Data in Fintech Influence the Customer Experience?

How Do Financial Businesses Benefit from Data Science?

Examples of Fintech Data-Driven Projects

Have you noticed the exponential growth in the amount of data being processed in various industries? The financial sector is certainly no exception, as the number of transactions has inexorably increased over recent decades. To manage all that data requires applying much more effort to data analysis, segmentation, and processing. It also demands tighter standards of safety and reliability. Unfortunately, not every type of software is able to adapt readily to the changing requirements of the market.

Financial companies are concerned about keeping up with the times and effectively using Data Science to provide high-quality products to customers.

The Role of Big Data in Fintech

Use Cases of Data Science in Fintech

How Can Big Data in Fintech Influence the Customer Experience?

How Do Financial Businesses Benefit from Data Science?

Examples of Fintech Data-Driven Projects

Keep reading this article to learn more about the role of Data Science in the fintech industry.

Data Science is a method of studying large volumes of structured and unstructured data via modern analytical tools.

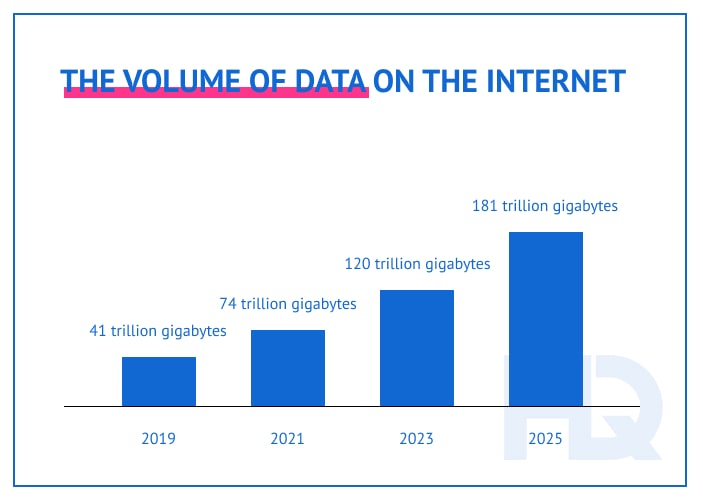

In 2021, the volume of collected data increased by 37% over 2020 and reached 74 trillion gigabytes. The numbers are absolutely striking.

Not only has the volume of data grown; so has the variety of data being gathered. This leads to difficulties in analyzing and structuring information that would present a daunting task for humans. That’s where Data Science comes in.

Data Science allows companies to receive comprehensive data analysis, predictions, and insights that can be used to improve every sphere of the organization’s processes.

Data Science combines several fields such as:

This combination of tools allows companies to perceive information more easily and find correlations among seemingly unrelated things.

An especially large volume of data gathered by organizations comes from the field of fintech. But how to analyze financial data? We’ll explain below.

Put simply, the term Big Data refers to a large amount of unstructured and unprocessed data that was gathered from various channels.

Due to the rapid development and advancement of modern technologies, such as IoT and mobile technologies, the fintech industry is collecting more and more financial data types, such as balance sheets, income statements, and other financial data examples for analysis. This analysis helps financial institutions understand their consumers better and develop well-thought-out strategies.

The concept of Big Data is based on principles that might be called the three Vs:

Using the right approaches to handling Big Data, fintech institutions can derive benefits such as:

To garner these benefits, data must be processed using special algorithms. And that is the mission of Data Science.

The more data the algorithms analyze, the more comprehensive and relevant the results will be. This explains the popularity of Data Science in the fintech industry, as there are huge amounts of data gathered in this field.

By using Data Science, financial institutions can make well-reasoned decisions and provide a personalized customer experience.

Data Science solutions to improve fintech projectsAn experienced team of specialists from HQSoftware is ready to handle your project. Let’s talk!

Anna Halias

Business Development Manager,

HQSoftware

But how exactly can companies implement Data Science? Let’s examine that more closely.

Below are some of the most common Data Science use cases in fintech, where the technology is a necessity or at least a highly desirable feature.

Fraudsters stealing company data and money is a nightmare scenario for every financial organization. So, they’re using every anti-fraud tool available to defend information.

For example, companies can implement Regulatory Technology, or Regtech, to strengthen security systems. This includes:

Also, Machine Learning algorithms can analyze the latest consumer experience and compare it to all previous activities. This enables organizations to proactively react to unusual actions.

By the way, small banks and credit unions are more likely to be attacked by fraudsters than bigger financial institutions. So, the combination of financial data analysis and Machine Learning analytics is an important means of protecting financial organizations of all sizes and their financial databases from falling victim to fraudulent activities such as speculator trading, rogue trading, and regulatory violations.

Data Science provides an organization with deep risk analysis and helps manage risks by implementing new features of risk detection systems.

Organizations can prepare for potential problems by simulating particular risks in a virtual environment. For example, they can perform risk analysis to see whether a potential borrower is likely to actually repay the loan. Risk simulation helps companies to understand the risk preconditions and monitor them effectively across the corporation.

Data Science creates a risk model based on the history of consumers’ transactions. It helps to determine if users are reliable and, if so, can offer them benefits such as lower rates and additional services.

Also, risk assessment via Data Science can improve audit management, as creating a risk assessment plan is a vital part of the auditing process.

Data Science analyzes a large amount of behavioral data using text analysis, natural language processing, and data mining.

Customer behavior analysis allows financial companies to:

Data Science combines the opportunity of creating customer behavior models and conducting real-time and predictive fintech analytics.

In this case, fintech Data Science analyzes banking databases and open financial data provided by clients along with their credit history. Also, particular banks have the right to exchange some financial information, which provides the opportunity to gather more data about clients.

This helps banks automate the process of defining the credit score of each client. No manual labor is required to predict whether the client is a good candidate for a loan.

Moreover, Machine Learning can match users’ behavior to credit scoring models and predict how likely the customer is to repay the loan.

Predictive analytics extrapolate from current data to forecast future trends. Thus, fintech Data Science can help to predict stock trends and market prices and help users make wise investments or develop financial strategies.

One more way of using Data Science is to create product improvement strategies. It helps organizations adapt to changing market demands, understand the weaknesses of the company’s products, and modernize them.

Data Science, combined with Artificial Intelligence, allows financial firms to introduce new products to users at the most favorable time when the market is the most responsive.

Algorithmic trading is a set of instructions programmed to solve trading issues, taking into account variables such as price, timing, and volume.

In developed markets, today around 70-80% of all trades are algorithmic, and these numbers are expected to grow up to 95% in the next few years.

Algorithmic trading uses mathematical formulas and models, along with human oversight, to find even the least obvious opportunities for successful trading. This combination allows firms to define whether it is effective to trade on a particular market at a particular time.

The big benefit of using special fintech Data Science applications is the speed of actions and reaction to the consequences. The algorithms ensure that if a particular step turns out to be wrong, the program will correct the decision-making model, taking the mistake into account.

Thanks to in-depth analysis of trends and customers’ preferences, financial companies can offer personalized ads and products for each segment of users.

Personalized marketing campaigns help to reach the target audience, improve customer retention, and make for a better user experience.

Personalization also improves the conversion rate and increases the return on investment, leading to better financial performance of the organization.

As you can see, financial data analysis can be used in a broad variety of spheres in the fintech industry. But a lot of attention is given to the correlation between Big Data and customer experience. We’ll explain that correlation below.

Using Big Data, fintech organizations can constantly improve the customer experience, because they’ll understand the behavioral traits and expectations of their clients. Effective Big Data analysis and financial data management help organizations to:

We can see the positive impact of Big Data on the customer experience. But the positive effect of Data Science on businesses doesn’t end there.

Another field where financial organizations can benefit from using Data Science is in improving internal corporate processes. Businesses can do this in several ways.

Using analytical tools can reveal new opportunities for a company’s growth and development. For example, using market data to analyze trends can help a business forecast whether it is profitable to enter a new geographical market.

Also, fintech Data Science can predict whether it is more cost-effective to invest in a new product or to improve an existing one.

Thus fintech data analytics helps in finding new opportunities, forecasting whether they will be profitable, and calculating when an organization can expect to see a return.

With the help of Data Science, organizations can assess which tasks take up most of their employees’ time and consider whether some of those processes can be automated.

For example, technologies can take simple but monotonous tasks off the hands of workers, leaving them free to devote time to more creative tasks, which will increase overall productivity.

This is a very important aspect of using data analytics. Leveraging data effectively, organizations can make thoughtful decisions and build successful business strategies. Analytical tools can share data in real-time and provide organizations with timely feedback that they can act on.

Also, data scientists can create models to predict the outcome of a particular business decision. It helps managers consider various options, choose the best one, and create effective plans for achieving their business goals.

Data analytics in fintech is helpful in not only gathering data about customers but also in collecting data about competitors. Data Science tools allow for conducting effective competitor research that organizations use to make pricing decisions, enter new markets, and improve business strategies to stay one step ahead of the competition.

With Data Science, financial institutions can analyze which areas of operation should be developed first to achieve economic efficiency. That allows them to make optimal use of their resources, allocating them to the high-priority tasks first.

To sum up, fintech organizations benefit greatly from using Data Science, because it improves many areas of operation, from revealing new opportunities to making better-informed decision-making processes.

Now, let’s take a closer look at some successful Data Science use cases in fintech.

Below are some examples of companies that have successfully implemented fintech Data Science in their business operations.

Recently, DBS bank has been actively investing in artificial intelligence and data-driven technologies. The bank has developed personalized insights about customers’ behavior and gives them personal recommendations related to making financial decisions. These technologies also help the bank detect unusual transactions and increase the level of safety.

Another case is the Curve company, which has implemented a Sift Science Machine Learning solution to increase its protection against fraud for its app that stocks credit cards into one card. The platform analyzes users’ behavior to reveal suspicious actions and signals, which helps to quickly identify and prevent fraudulent use.

One more interesting example is using Machine Learning for banking data analytics in particular receipt management. Scotiabank has implemented Sensibill’s platform for mobile banking services, which allows users to take photos of their bills. The data science application stores and structures customers’ purchase documents and provides easy access to them. This gives users an effective way to manage both paper and digital receipts.

Data Science can also be used to automate customer interactions. For example, an Australia-based bank lender collaborated with the DemystData platform to speed up the processing and verification of clients. The data-driven platform is used to automate interactions with clients, eliminating 40% of manual verifications.

Several profitable and notable projects for the fintech industry were also developed by HQSoftware company. Some are described below.

The HQSoftware fintech development team has worked with various types of fintech projects for banks, traders, and other organizations. With more than 20 years of working experience, the company provides financial data services and has helped to successfully improve the business performance of many companies.

Here are some of those examples of data science applications in finance.

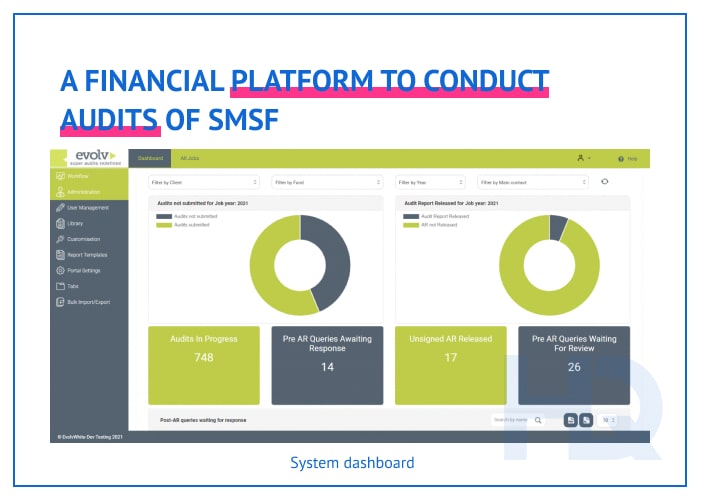

The goal of the platform is to automate and maintain audits for self-management superfunds. HQSoftware developers rebuilt the architecture of the existing solution and improved it significantly.

This platform consists of two parts: White and Black.

The White module is a totally automated solution used for managing clients and processing audit requests.

The Black module is a management solution for SMSF which is used to perform check-ups. It eases complicated auditing processes and runs audits from start to finish.

Thanks to the modernized platform, audit processing that used to take 2 weeks now is finished within 4 days.

A Swedish fintech startup turned to HQSoftware to develop a cloud-based solution for accounting and tax management that can be integrated with other accounting software.

The platform obtains and analyzes transaction data, calculates tax, and fills out statements for taxation authorities. It collects all accountable activities in one place and meets the criteria of local tax legislation.

The solution also offers integration with tax accounts. So it allows for keeping all tax information in one place, easily editing figures, exporting, and sending documents to the tax agency.

Simply put, the solution significantly facilitates work involving accounts and taxes for various financial organizations.

At present, the application has tens of thousands of active users, and this number is rapidly growing.

A large digital bank turned to HQSoftware to build a real-time bidding platform for federal retail chains, local businesses, and online shops.

Using Machine Learning technology, the advertising platform categorizes the audience into segments based on factors such as:

The platform tracks users’ activity on the websites, collects and stores the data, creates 3D user profiles based on their behavior, and shows highly targeted ads.

As you can see from all this, the role of Data Science in fintech is immense and affects the industry in countless ways. It helps solve day-to-day problems faced by each financial organization. The mix of algorithms, technologies, fintech analytics, and visualization allows companies to keep an eye on trends and quickly react to changes.

To sum up, Data Science in fintech offers the following benefits:

The possibilities of Data Science are rapidly growing, revolutionizing common perceptions of major business processes. In the near future, this technology will allow for even more effective expansion of product offerings and business generally.

If you need to implement a Data Science solution or need help understanding what kind of Data Science solution best fits your company, feel free to contact us.

Technology Researcher

Professional researcher at HQSoftware. Interested in solutions for retail, entertainment, and software that makes people's lives better.

We are open to seeing your business needs and determining the best solution. Complete this form, and receive a free personalized proposal from your dedicated manager.

Sergei Vardomatski

Founder