Why Is Risk Management So Important in Fintech?

What’s the Difference between AI and ML in Fintech?

The Roles of AI and Machine Learning in Fintech

In fintech, risk and human error are closely related concepts. In addition to external risks, many internal risks can occur due to human error, such as leaking of sensitive information or missing data.

In this article, we’ll explore how introducing Artificial Intelligence and Machine Learning technologies can mitigate the negative impact of mistakes and enhance your fintech risk management framework.

Why Is Risk Management So Important in Fintech?

What’s the Difference between AI and ML in Fintech?

The Roles of AI and Machine Learning in Fintech

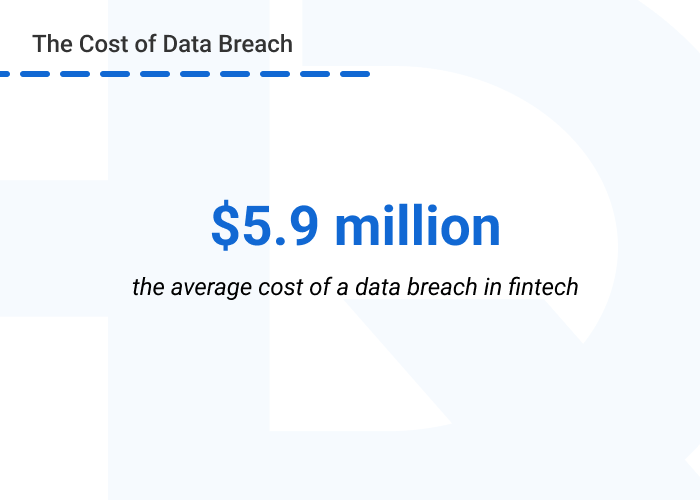

Fintech businesses deal with sensitive information, such as customer data and monetary assets, making them attractive targets for fraudsters. For example, it’s projected that about 45% of organizations globally will experience cyberattacks by 2025, with the average cost of a data breach in fintech hovering around $5.9 million.

Ensuring operation resilience, navigating market volatility, and mitigating potential loan defaults are all especially challenging tasks for financial organizations. You must also consider the impact of external factors such as politics, economic shifts, and the need for constant innovation, which each introduce their own set of risks.

To effectively handle all these issues and remain capable in critical situations, fintech businesses should have comprehensive recovery plans for various scenarios.

This is where risk management in fintech comes in, aiming at identifying, assessing, and mitigating potential risks. To do this effectively, companies need to analyze vast amounts of data, which can be challenging without cutting-edge technologies, So, AI/ML implementation for fintech risk management becomes inevitable.

While Artificial Intelligence is designed to perform tasks that require human intelligence, Machine Learning is a subset of AI that focuses on developing algorithms that enable computers to learn from data.

Using ML algorithms, AI can analyze historical data to identify trends and patterns, make predictions, and adapt to new information. These capabilities enable predictive analytics, enhanced fraud detection, credit scoring, and more.

Additionally to Machine Learning, AI in fintech can leverage:

All these specialized techniques, along with Machine Learning, empower the fintech industry to enhance the customer experience, improve decision-making processes, and innovate in financial services.

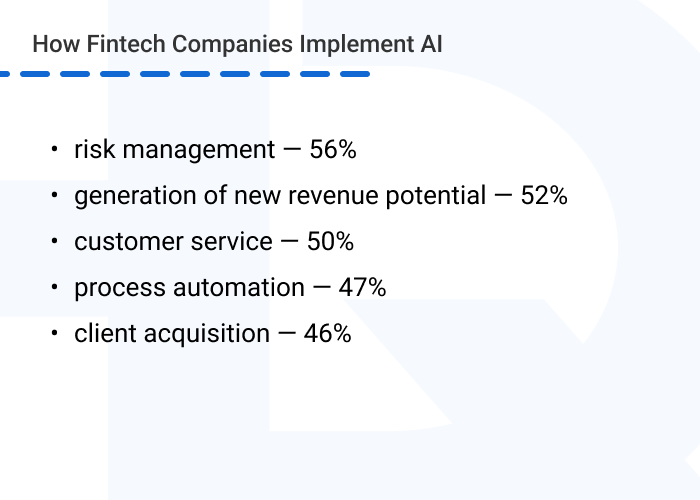

According to research, fintech companies typically leverage AI and ML technologies for:

We’ve already described each of these use cases in a separate article. So, for now, let’s explore why so many organizations have adopted AI in financial risk management.

With AI’s ability to analyze vast amounts of data and identify correlations between seemingly unrelated elements, the technology significantly enhances risk management in fintech by:

For example, by implementing ML algorithms, American Express improved its risk models by 30%, resulting in faster decision-making.

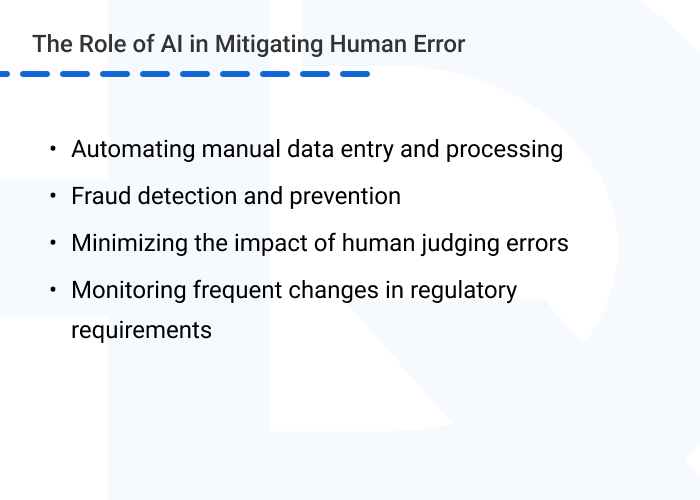

No less importantly, Artificial Intelligence plays a crucial role in eliminating human errors, which can lead to additional risks if not addressed promptly.

About 95% of data breaches and cybersecurity issues are caused by human error of one kind or another. So, implementing Artificial Intelligence for work automation, especially in error-prone tasks, becomes more crucial than ever.

First, you can automate manual data entry and processing by implementing document recognition and verification.

We developed such a system for our client, a US-based company that processes remittance note for healthcare organizations. To speed up remittance note processing and eliminate errors in manual data entry, HQSoftware’s team created a system powered by Machine Learning that recognizes information from scanned documents and reorganizes it in editable e-forms. Documents are also checked for OCR errors and corrected by an algorithm. With this solution, the client was able to speed up remittance note processing by 9 times and now can process several documents in parallel.

Want to enrich your fintech solution with AI/ML technologies? We’re ready to help!HQSoftware has a team of skilled professionals ready to tackle the project. Ask me!

Anna Halias

Business Development Manager

Another crucial area where human errors can have severe consequences is fraud detection and prevention. Unlike humans, AI can process and recognize fraudulent patterns in real time, minimizing the chance of overlooking subtle indicators. Moreover, AI systems monitor transactions and user behavior continuously, enabling a proactive response to any suspicious activity.

For example, by implementing Mastercard’s AI tool, banks could save about $125 million in one year across the UK by detecting and preventing fraudulent payments.

Minimizing the impact of human judging errors in decision-making is another area where Artificial Intelligence can help.

When providing predictions and recommendations, AI systems rely on statistical methods and data analysis, performing faster, more accurately, and on a larger scale than humans can achieve. By prioritizing objective information, AI minimizes the impact of cognitive biases that may affect human decision-making and risk management in fintech.

Monitoring frequent changes in regulatory requirements and maintaining compliance with the latest regulations can also become an AI task, eliminating human errors. With AI, you can be sure that regulatory changes are promptly identified, correctly interpreted, and incorporated into operations, mitigating the risk of non-compliance and associated penalties.

Developing financial solutions with Artificial Intelligence for these purposes can not only mitigate human error but also significantly improve risk management.

A fintech risk management framework consists of four steps:

Let’s explore how AI/ML technologies can improve these steps.

This step is needed to organize how risk management is performed in your fintech organization:

Discussing the implementation of AI/ML technologies is also crucial at this step and should be included in the plan.

Within this step, you and your risk management team should define all potential risks within your fintech organization. Generally, they fall into two categories:

When risks are defined, quality and quantity risk analysis should be performed. Quality analysis needs to identify the likelihood of each type of risk, while quantity analysis calculates potential financial losses that can be caused by each risk.

This is where you can leverage AI in financial risk management. Predictive analytics powered by Machine Learning can help you make predictions about the likelihood and severity of risks based on historical data and current trends. So, you can make data-driven decisions during risk assessment.

To avoid biased or inaccurate predictions, it’s important to choose a relevant mathematical model for the ML algorithm and train it with a sufficient amount of data. This and some other challenges of implementing AI/ML in fintech can be resolved with skilled software developers who understand business needs, as those at HQSoftware do, so as to choose relevant algorithms. Our specialists have worked with predictive analytics not only in fintech but in other industries, for example, WMS.

Based on the insights provided by ML models, it’s important to develop response strategies when a particular risk occurs, as well as risk mitigation plans. These may include implementing AI anomaly detection algorithms for cybersecurity, utilizing predictive modeling algorithms for credit risk assessment, or implementing AI to monitor regulatory changes and updates.

Also, you can implement AI-driven scenario analysis to simulate various economic, market, and operational scenarios, the better to understand their potential impact on operations and adjust recovery plans accordingly.

By constantly analyzing vast amounts of data for anomalies and patterns indicative of potential risks, AI can significantly enhance risk monitoring. AI ensures a proactive and dynamic approach to risk management in fintech, reducing the likelihood of oversights and enhancing overall risk resilience.

Using Artificial Intelligence for a fintech risk management framework, you can foster a proactive and adaptive approach to risk identification and mitigation, laying the foundation for sustainable and secure operations in the dynamic finance landscape.

By introducing AI and ML technologies in risk management, fintech organizations can deal with almost any challenge in a rapidly changing business landscape, including:

Artificial Intelligence is actively penetrating all areas of business. So, to stay on top of the competition, you need to adapt to these changes, especially since they open up many new capabilities.

To explore how you can enhance your fintech solutions with AI/ML technologies, whether for risk management, fraud detection, or other purposes, feel free to contact us. Our specialists will schedule a call with you to learn more about your needs and then consult on the most profitable AI/ML implementation options.

Head of Production

To ensure the outstanding quality of HQSoftware’s solutions and services, I took the position of Head of Production and manager of the Quality Assurance department. Turn to me with any questions regarding our tech expertise.

We are open to seeing your business needs and determining the best solution. Complete this form, and receive a free personalized proposal from your dedicated manager.

Sergei Vardomatski

Founder