Use Cases for AI and ML in FinTech

5 Benefits of AI and ML for Fintech Companies

Top FinTech Companies Using AI

Analytics and forecasting, security and risk management, chatbots, and virtual assistants are among the most popular ways financial companies can employ Artificial Intelligence (AI) and Machine Learning (ML). With the ability to raise the standard of effectiveness and security, AI and ML are gaining popularity among the fintech industry, garnering an expected market value of $61.30 billion by the end of 2031.

Having worked on several fintech projects with AI implementations, in this article we’ve gathered the most common use cases of AI and ML in fintech and outlined how they can improve your financial software.

Use Cases for AI and ML in FinTech

5 Benefits of AI and ML for Fintech Companies

Top FinTech Companies Using AI

85% of fintech companies have already enhanced their financial software with AI and ML technologies to provide high-quality and secure services. AI use cases in fintech include:

This is perhaps the most popular way for fintech companies to benefit from incorporating AI and ML. According to research, about 43% of financial services companies employ ML algorithms for advanced data analytics.

AI-based solutions help users make complex calculations and predictions, eliminating human error. Here are some examples of how to utilize AI and ML in finance:

Using AI in analytics and forecasting, you can save money on unprofitable credit and loans and get individual recommendations that anticipate negative outcomes, resulting in saved resources.

According to research, about 56% of fintech companies use Artificial Intelligence for risk management.

AI algorithms can identify potential risks by analyzing historical data on companies’ financials, transactional behavior, and even customer profiles. For example, AI algorithms can determine anomalies and patterns of fraudulent behavior to detect cybercrimes such as money laundering, credit card fraud, and identity theft.

Anti–money laundering (AML) efforts represent a critical area where AI and ML are necessary. These algorithms can investigate complex money-laundering schemes that may be difficult to identify with traditional fraud detection systems. Using AI and ML in fintech, you can detect deviations from typical behavior and flag transactions or entities that require further investigation for potential money-laundering.

In fintech, RPA involves AI assistants for automating repetitive tasks typically performed by humans. These include:

When you incorporate RPA into your financial software, you can focus your resources on high-value business tasks, while robots will handle repetitive manual processes.

For example, by implementing RPA, Zurich Insurance significantly reduced processing time by automating data re-entry, validation, and balancing between systems, as well as decreased the number of customer service requests.

Considering the viewpoint of 71% of users, AI can enhance customer service by enabling chatbots and virtual assistants to answer customers’ questions and facilitate 24/7 support.

In the fintech industry, these AI and ML solutions can provide instant responses and guides to carry out various financial processes. AI assistants can notify users of impending bill payments and display transactions, payments, and account information.

For example, by using the virtual assistant Eno, Capital One Bank significantly improved customer service by helping clients solve common problems, such as account checking, balance monitoring, and creating digital credit card numbers for online transactions.

By examining consumer historical data and behavioral patterns, AI systems can offer end-users customized recommendations for various financial services, including:

With AI-powered solutions, you can offer your customers the opportunity to boost their personal financial situation, eventually leading to increased client loyalty and business success.

A bright example is a personal finance app Wally, which automatically tracks your bills, cash flow, and even spending to help you plan a proper budget. By analyzing your revenue and expenses coming from bank accounts, credit cards, or even loan accounts, the app can generate personalized recommendations regarding the amount and timing of savings.

Among all the potential use cases for AI and ML in fintech, this is a fast-emerging one, with an estimated market size of $41.9 billion by 2030.

Algorithmic trading executes stock trades by adhering to a pre-programmed set of instructions that evaluate data and make trading decisions.

The fintech AI and ML system can recognize trading patterns and react promptly to shifting market deals thanks to their ability to continuously analyze and learn from millions of data points. Therefore, AI algorithms can place trades at the best pricing, reducing trading risks and ensuring bigger returns.

One of the most successful companies that use AI algorithmic trading platforms is Renaissance Technologies LLC, which has generated about 66% annual returns. The platform uses trading techniques that are supported by data analysis and mathematical models.

Now let’s take a closer look at the benefits of AI in fintech that can come from the use cases described above.

Some key advantages of implementing AI and ML for finance companies are:

While a fintech business deals with an endless flow of financial transactions, it can be difficult to pinpoint suspicious actions using only traditional security measures, such as firewalls. That’s where AI and ML come in. As stated in the research, 42% of financial companies use AI for fraud and anomalies detection.

AI fraud detection systems can analyze data from various sources, including transactional data, customer profiles, external databases, and even social media, to gain a comprehensive understanding of potential fraud indicators. By considering a wide range of data points, AI algorithms can uncover hidden correlations that may not be apparent through manual analysis.

ML models can find anomalies in user behavior and quickly spot any fraud attempts, as well as questionable transactions. For instance, by learning from historical fraud cases, ML algorithms can detect unusual patterns, such as sudden high-value transactions or transactions in unusual locations, that may indicate fraudulent activities.

So, by leveraging Artificial Intelligence for fintech services, you can significantly reduce fraud losses and improve security measures in areas such as payments, transactions, and account activities.

Need to implement AI into your financial software? We’re ready to help!HQSoftware has a team of skilled professionals ready to tackle the project. Let’s talk!

Anna Halias

Business Development Manager

Machine Learning in fintech can simplify banking procedures, generate forecasts, and automate document processing. For example, 78% of companies say that having back-office tasks automated by AI frees up more time for more important areas of their jobs.

Therefore, by implementing AI automation for your financial services, you will be able to:

To help you deliver personalized customer service, Machine Learning fintech algorithms analyze customer data, transaction history, and even clients’ behavior. By understanding individual customer needs, you can offer tailored product recommendations, customized financial advice, and personalized marketing campaigns.

As a result, by implementing AI customer service, you will be able to:

With the ability of AI to find the non-obvious relationships between data and assess their influence on your business flow, the technology can help you significantly improve decision-making processes. So, with AI-based solutions, you can:

By analyzing market data, historical performance, and risk factors, AI models can identify the most optimal allocation of assets within investment options. This helps financial institutions balance risk and return, diversify portfolios, and maximize the efficient use of available resources.

AI may also divide consumers into categories by analyzing their behavior, preferences, and other data. This kind of segmentation allows for the targeted deployment of resources, such as marketing campaigns, specialized product offerings, or individualized customer care. As well, AI can calculate the optimal timing to focus advertising spending for maximum conversions.

To sum up, by using AI and ML for your fintech services, you will be able to handle a greater volume of inquiries without involving human resources, provide faster and more secure fintech transactions, and reduce money loss.

To better understand the positive impact of AI and ML on business efficiency, let’s take a look at some examples of how fintech companies use these technologies.

AI and ML technologies continue driving innovation and enhancing customer experiences for banks, traders, and other businesses. Some of the fintech companies using AI and examples of their solutions are outlined below:

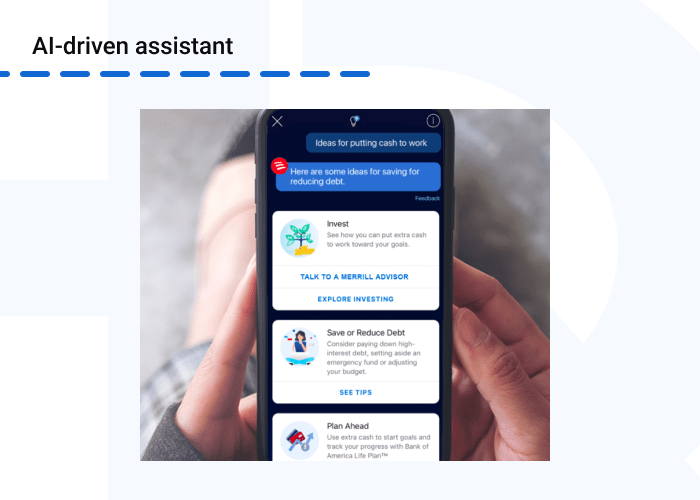

To improve customer service across all its branches, Bank of America decided to implement a virtual AI-driven assistant.

The assistant helps customers with their financial needs and guides them through various financial services via voice, text chat, or on-screen gesture. For instance, it can alert clients if their spending is higher than usual or their checking account balance is approaching zero.

Additionally, it can help with frequent queries, including billing disputes, fees, deposit holds, and issues about transactions. Now, Erica is the most used virtual banking assistant, that has guided about 32 million clients through more than 1 billion interactions.

A US insurance company turned to HQSoftware to create an application enhanced by AI technology for automated document recognition to simplify and speed up invoice processing.

The software includes a series of pre-trained templates that can recognize the data on uploaded PDF invoices and compile it into an editable e-form. Using an ML algorithm, the system can check the submitted invoices, match the missing data with the correct institution, extract the necessary information from the available documents, or remove duplicate invoices in case of missing specific information. For example, account details.

As a result, the system can accurately differentiate between five different document template types with a 70% accuracy rate and process simultaneously 12–15 documents per minute.

To enhance the security of their software, Nasdaq deployed a deep learning–based system. It can track more than 17.5 million trades per day, identify fraudulent equity orders, alert the appropriate authorities, and maintain open markets.

Examining unusual trade patterns can even reveal odd occurrences that may turn out to be new varieties of fraud. Today over 60 marketplaces, 20 regulators, and 160+ market participants are powered by the technology in 65 countries, making Nasdaq the world industry leader.

Overall, the future of AI in fintech is bright; it has the potential to revolutionize various aspects of the financial industry, empowering you to improve payments and transactions, mitigate financial risks, and significantly enhance customer trust.

Trying to leverage these opportunities, 86% of financial companies are going to boost their investments in AI by 2025 with AI-powered analytics and reporting becoming a global fintech trend between 2023 and 2028.

Another area that is forecast to demonstrate rapid growth is fraud detection. For example, the banking sector stands to save about $1 trillion by 2030, thanks to implementing AI technologies.

Overall, it is predicted that in the coming years, AI will be actively used for:

However, because of its complexity and the need for specialized expertise, implementing Artificial Intelligence in fintech can present numerous challenges for finance companies. Hiring a software development partner with relevant experience in AI and ML implementation can indeed be beneficial in overcoming these issues and ensuring successful adoption of this technology.

Creating AI fintech applications demands a lot of practical experience. We at HQSoftware understand how to make a seamless massive data stream, enhance the system with the ability to recognize and process financial data in various formats, and develop a solution that conforms with the laws in your region. By partnering with HQSoftware, you can enhance your financial software with:

Feel free to get in touch with us to learn more about our financial app development services.

Head of Production

To ensure the outstanding quality of HQSoftware’s solutions and services, I took the position of Head of Production and manager of the Quality Assurance department. Turn to me with any questions regarding our tech expertise.

We are open to seeing your business needs and determining the best solution. Complete this form, and receive a free personalized proposal from your dedicated manager.

Sergei Vardomatski

Founder