Money Lending Software Development Services

Create a personalized solution that meets all your requirements

Consulting to choose an optimal technologies for lending software

Prototyping or MVP to verify the business idea

End-to-end development of loan solutions

Improvement and extension of functionality

Integration with third-party solutions, such as CRM and payment systems

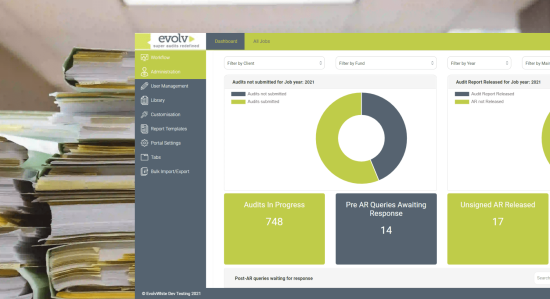

Loan Management Software Development

Automate your operations and provide top quality services

Cloud lending software development

This is an easily scalable system that will speed up financing processes and improve interactions with borrowers. Thanks to all data being stored in the cloud, you can easily access and manage documents from any device in real-time and be confident about data security.

Software for microfinance

This software allows you to automate business processes and quickly process incoming requests, saving time and eliminating human error. The system will also boost customer loyalty and help you acquire new clients.

PayDay loan software

The software will help you perform financial operations, from application processing to money transfer, faster and more accurately, resulting in enhanced customer satisfaction and a higher conversion rate. The system will also assist in reducing delinquent loans by tracking and collecting payments. Automation of the approval process also enhances decision-making.

Mortgage management

Mortgage management software allows you to manage all property-related financial operations more effectively. It automates the entire lifecycle of customer interaction from risk assessment to approval, ensures regulatory compliance, and streamlines claims management.

Payment lending software solution

Loan or lending software development allows you to offer your clients various payment methods, from cards to digital wallets, and to easily control all transfers and other payment information. By automating lending procedures and eliminating monotonous work, you can significantly reduce time and cost.

Credit analysis software

This system uses machine learning to improve business efficiency and provide comprehensive customer analysis. It speeds up the loan origination process with improved underwriting and accurate assessment of potential borrowers. The software also provides comprehensive reports and improves decision-making.

P2P lending software solution

P2P loan software will help you easily connect borrowers with lenders without intermediaries. It ensures accurate and rapid checks of lenders’ backgrounds and keeps all your existing data safe. In addition, personalized services and a wide range of features for each type of user will improve the user experience and boost customer loyalty.

P2P lending keys

P2P loan/lending app development enables real-time connections between borrowers and investors and offers the most suitable individual options to users with different capabilities and demands. It will help speed up all your business processes and improve productivity. The software also provides a high level of security, including ID verification and online payment security.

Certificates: Implement Your Financial Solutions With HQSoftware

Mastering skills above & beyond for outstanding custom finance services

Choose from a Variety of Lending Software & Solutions

Choose lending software that covers all your needs

Crowdfunding

With an advanced crowdfunding platform, you will be able to cover various customer needs, from donations to rewards. The system ensures data and payment security and simplifies the transfer of funds. It allows you to reach users all over the world, improve external collaboration, and provide a smooth user experience.

P2P loan software

The system eliminates the need for customers to visit a bank or other financial institution, as it allows them to make transfers directly, using various payment gateways. The P2P loan app enables you to track financial transactions in real-time and provides easy document management.

Invoice financing

Software for invoice financing speeds up the loan approval process and improves interactions with your customers. The system is also responsible for collecting, streamlining, and sorting payments, which results in efficient document management and minimized paperwork.

Loan comparison

Loan software that provides comparisons is the right option to improve your existing lending system. It offers users easy-to-understand reports comparing several credit options and helps them choose the most suitable one, which ultimately will increase the trust and loyalty of your customers. This software improves the user experience and increases conversion and retention rates.

Credit scoring

A credit scoring solution provides a transparent analysis of incoming applications, reduces risks, and protects the lender’s interests. The system automates lending processes, assesses customers’ creditworthiness, and eliminates human error. It analyzes a large number of metrics, such as insurance information, credit limits, and others to ensure the reliability and high quality of your services.

Auto finance

The solution for auto finance is designed to speed up and automate deals, offering better services for clients. The system enables real-time approvals, provides a high level of security to reduce the risk of fraud, and enables third-party integrations. It also simplifies document creation and management, provides quick and simple access to data, and ensures regulatory compliance.

Credit risk reporting

Credit risk reporting software is designed for advanced reporting and analysis. Using a wide variety of statistical methods, the system offers comprehensive reports that help you tackle delinquencies and improve your decision-making. It also eliminates client underestimating and allows for insurance management.

Debt collection software

This solution simplifies the debt collection process and helps you meet the fast-changing requirements of the collection industry. It increases employee productivity by eliminating recurring processes and organizing their tasks efficiently. The software also provides you with easy access to debtor profiles and improves invoice management.

Merchant cash advance software

This solution will strengthen collaboration between funding companies and merchants and allow you to bring users up-to-date information quickly. The system will provide real-time lead statistics, help to control the underwriting process, and offer suggestions on loan repayment terms to streamline workflow and increase productivity.

MCA portals & payments

This system integrates with various payment gateways and can handle a variety of payment methods. It allows you to schedule payments, tracks commissions, monitors every step of the payment procedure, and alerts you to any errors that occur.

Technology Focus in Billing Software Development

What skills we are mastering

Partnerships Beyond Business

We work with people, not logos

How We Work

Steps for establishing close collaboration to create a lending software solution

Technologies

For lending software development we use modern technologies such as Artificial Intelligence, Machine Learning, IoT, and others to create a reliable and bug-free system. We also provide easy-to-use APIs that ensure smooth integration of the solution with various third-party services.

Features

Your solution will provide all the necessary features to handle all tasks and meet industry requirements, including a high level of security, ability to control every step of the lending process, comprehensive analysis, and others.

Expertise in lending software development

Over the course of our work, our professional engineers have created high-quality solutions with seamless performance that automate loan processes, speed up the entire lifecycle of lending procedures, and bolster user loyalty and improve conversion rates.

FAQ with Loan and Lending App Development Company

What is a loan management system?

What are the benefits of loan origination software?

We are open to seeing your business needs and determining the best solution. Complete this form, and receive a free personalized proposal from your dedicated manager.

Sergei Vardomatski

Founder