Why are trading apps in demand?

Must-have features of a stock trading application

How much does it cost to build a stock trading app?

The development process for a stock trading app

How to monetize a stock trading app

Today, millions of people all over the world see investment as a form of primary or additional income. With the rapid development of fintech and mobile technologies, stock trading apps have become widespread. They are easy to use, process vast volumes of data, and allow investors to trade at convenient times. Stock trading apps are great investment options since such solutions comply with various monetization models and are highly popular in the fintech market.

Stock trading app development is a complex process that requires technical and business expertise. Drawing on our experience in fintech app development, we’ve highlighted the most crucial points and approaches related to engineering trading software.

Why are trading apps in demand?

Must-have features of a stock trading application

How much does it cost to build a stock trading app?

The development process for a stock trading app

How to monetize a stock trading app

Plenty of people are looking for better ways to multiply their savings, and stocks never lose popularity. The majority of investors prefer to use smartphones for their transactions, so they need an intuitive user interface and strong security. Banks often cannot offer the same level of profitability, and the number of banking crises in recent years is another reason to choose to invest in stocks. One more important factor is that trading apps make investing cheaper. Thus, stock trading management is currently one of the more high-prospect fields of mobile app development.

Want to create a profitable stock trading app?HQSoftware can help you develop cutting-edge fintech apps for stock market trading

Anna Halias

Business Development Manager,

HQSoftware

A stock trading app provides easy ways to buy and sell stocks, company shares, or cryptocurrency. It also makes it possible to see what is happening in the markets, thanks to integrated financial media and analytics. The app has all options necessary to send money from/to the user account. The big advantage of the app is radically lower charges compared to a traditional brokerage, or even no charges at all. Certainly, such apps often introduce some premium services or may take a small percentage in interest from cash deposits.

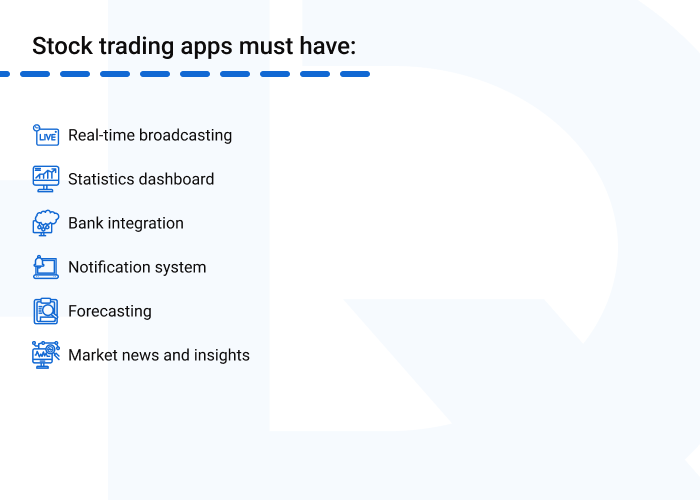

Some essential elements must be included in any outstanding and user-friendly stock trading app.

The main features needed in a stock trading app are:

What else should a stock exchange app have?

It stands to reason it’s impossible to accurately calculate the cost of developing a stock trading app since every case is unique. Among the factors that influence the cost are the solutions set, operating system, final solution interface, cloud services, and whether a prototype is needed. Development of a feature-rich fintech app will take at least 1000 working hours or 5-10 months. The scope of work can consist of:

HQSoftware’s estimate process is absolutely transparent. We are ready to offer a quick but thorough estimate for your project once we have all the details. We will be happy to explain all risks encountered during production, thus avoiding the need to increase your budget in the middle of development. We’d love to act as your partner, not just as engineers.

Want a fair price for a stock trading app?Partnering with HQSoftware, you’ll get detailed expertise.

Anna Halias

Business Development Manager,

HQSoftware

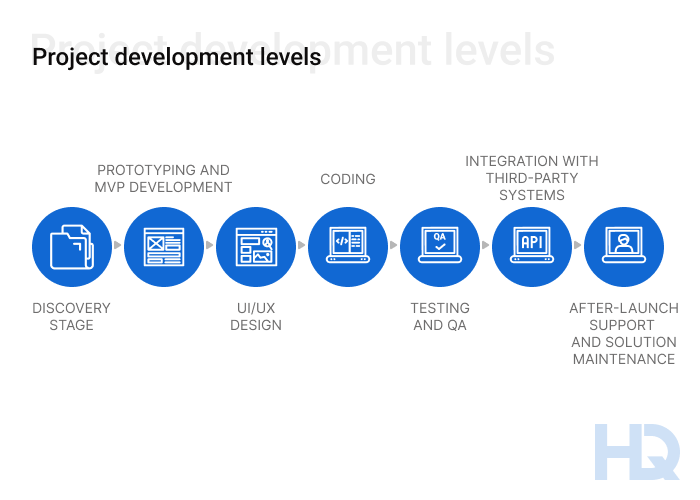

The most-used approach to fintech app development is a cross-functional team approach, accompanied by QA taking the role of app users. Developing such a platform involves various stages: research, idea development, defining the UI/UX design, software code writing, testing, delivery, and maintenance. The development process is divided into frontend and backend, mobile for iOS and Android, etc. Our developers offer technical support and a special small team for updates, in addition to QA.

Speaking of development technologies, we need to mention that Angular and React JS are used in front-end development. These are excellent solutions for large-scale projects, especially for fintech. As to backend technologies, Node JS and .Net are most often used. All of these technologies are great when engineering complex solutions such as stock trading.

Mobile-first design should be a priority. The app’s UI/UX should take into account typical mobile users’ needs, such as micro-interactions and limited screen space. The next step is to integrate the app with third-party systems that provide stock market data (real-time indices, rates, etc.) from Yahoo Finance, Bloomberg and other relevant media integrated with the app via API. Some APIs focus on real-time data, while others specialize in crypto, exchange rates, stock market feeds, stock metrics, and research functionality. Some others concentrate on investment accounts and law.

Testing a trading app means more than classic quality assurance testing, such as checking UX or algorithms. It also includes stress testing to check how the app behaves if you make one transaction per second, for example.

The next stage after launch is maintenance. This is the process of changing, modifying, and updating software to more precisely meet all the needs of stakeholders and users. Software maintenance is done to improve code quality, boost the solution’s performance, fix bugs, etc.

So, it’s a given that stock market trading apps will grow rapidly. They’re not only a means of gaining or saving money but also a kind of entertainment. Investment in the lifestyle of new generations can be profitable both for the owners of stock trading apps and for their users. On our side as software developers, we can offer our best experience, best practices, and best developers to create fintech market products that bring value.

We developed a similar product for one of our clients. Its fundamental part (basic API for the client’s base) was made on Node JS. We also used Swagger for documentation and API for possible integration of the platform as a separate third-party for other services. This also provided a connection to API only via identification/authorization keys.

A single-socket connection between the server and the service was implemented. This provides a maximum “positive” configuration of supporting connection and reconnection, errors, and notifications processing. When the receiving “socket” connection gets new data, the processing algorithm sends it to its relevant namespace/room via the sending socket service, putting the last data updates into the cache base. The attribute of its channel/room/ namespace is the trading pair and its rate.

The last update cached in Redis is needed for giving this data to new users/clients that have opened the UI (request via API). It also provides the latest updates from the cache to be saved in the MySQL database using the Cron service, thus generating necessary reports based on implemented internal triggers.

We used various types of data and tools: API authorization keys, users’ accounts, widget and mini components settings, dynamic/flexible sets of margins, for widgets/tables of reports using MongoDB.

Such an approach has helped us make the server part scalable. It allows for using SSO principles to make a cluster that contains server logic, cache and operational data dependent on a region and self-scalable thanks to Docker, Docker Compose and Terraform. MongoDB can be set up in the form of a replica set/shard. MySQL can be stored in a specific “point” with a customized backup system isolated, according to all relevant security principles, with only one data entry point isolated, according to all relevant security principles, with only one data entry/exit point.

This architecture makes it possible to distribute the load correctly between various server components without drawing too heavily on system resources. Also, this architecture can be easily exported as a server-based solution as well as a cloud solution.

There are various forms of fintech apps with different revenue patterns. Some are designed for personal finance management, combining functions such as tracking payments, monitoring income, planning budgets, etc., handling cryptocurrencies, crowdfunding, lending, banking, money transfers, insurance, and payment apps. There are amazing examples of monetizing fintech apps. While these can be overestimated, some have earned profits exceeding a billion dollars.

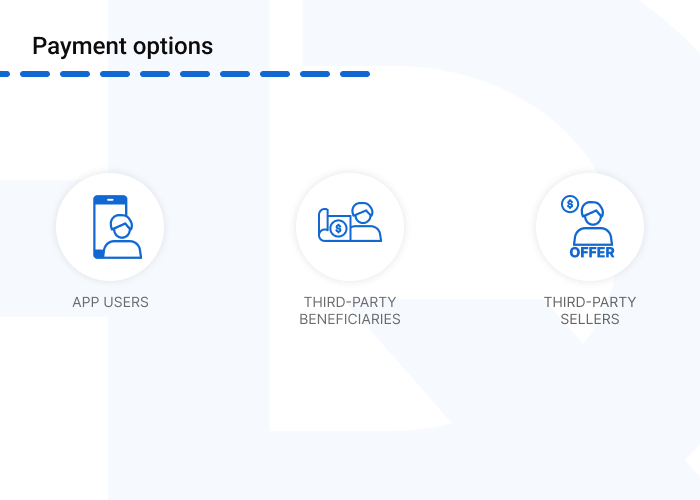

Speaking of monetization, it’s important to define from the beginning who will pay. Choices include:

How can advertising lead to earnings?

How can you monetize an app without ads? One common approach is the freemium model — a hybrid between free and premium apps. Here the user is offered a free app with several features, with the possibility of transitioning to the paid version if the user desires all the premium services.

In-app purchases, subscriptions, referral marketing, and M-commerce are other kinds of monetization without ads, but they are less relevant when it comes to stock trading apps.

Not a single app can be launched without checking whether it meets legal and security requirements. The majority of stocks are issued in the USA; therefore it’s important to meet the rules of the US Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA), and National Futures Association (NFA). Also, it is important to implement the Know Your Client (KYC) standards for broker-dealers and other companies in the fintech area. This rule sets out requirements for opening and managing an investor’s account. Know Your Client includes FINRA Rule 2090 (Know Your Customer) and FINRA Rule 2111 (Suitability). It guarantees that the investment advisor limits risks to the volume coordinated with the client.

In addition to KYC, traders need to observe anti-money laundering (AML) laws. Their AML compliance solution should have transaction monitoring that tracks suspicious activities. This software prevents various forms of illegal financial transactions or investments. If a company does not comply with anti-money laundering laws, it can face huge fines from governmental institutions.

The development of a stock trading app is a real challenge that requires precise attention to all details and a systematic approach throughout the development cycle. Top-rank apps also require precise integration with accounts, stock markets, financial data, etc. Discovery, coding, UX/UI design, integration with third-party software systems, quality assurance, and project management are the typical steps. But behind each of these stages are hundreds of challenges that can only be met by a team of highly skilled professionals with deep insight into every area of the project. HQSoftware provides top-quality fintech software development services and guarantees the engineering of top-tier stock trading apps that brings value.

Head of Production

To ensure the outstanding quality of HQSoftware’s solutions and services, I took the position of Head of Production and manager of the Quality Assurance department. Turn to me with any questions regarding our tech expertise.

We are open to seeing your business needs and determining the best solution. Complete this form, and receive a free personalized proposal from your dedicated manager.

Sergei Vardomatski

Founder