Certainty and predictability are the keys to a well-functioning insurance business. But in a rapidly changing environment, anticipating risks becomes more difficult. Artificial Intelligence and Machine Learning can help with that.

How Important is AI for insurance?

Insurance is a business that benefits from predictability. If the outcome is certain, insurance firms are more comfortable offering value at fair rates while generating income. Both customers and shareholders win in this situation.

But here’s the problem: with megatrends on the horizon, such as the arrival of self-driving cars and accelerating climate change, predicting change is becoming much more complicated.

In this environment, knowledge and information are the keys to survival, and the companies that adapt fastest are more likely to stay competitive and bring the most value to their customers.

Predictability that AI offers is key to staying competitive for insurance companies.

The technologies that best suit the need of insurance companies to anticipate change are Artificial Intelligence and Machine Learning.

New insurance firms that adopt and benefit from these technologies — so-called insurtechs — are likely to be more agile than their competitors. They are able to better understand their clients, react to market changes, and make a profit providing real value.

In what ways can Artificial Intelligence improve insurance?

Adopting AI in insurance can facilitate the following processes:

Sudden disaster-caused damage analysis

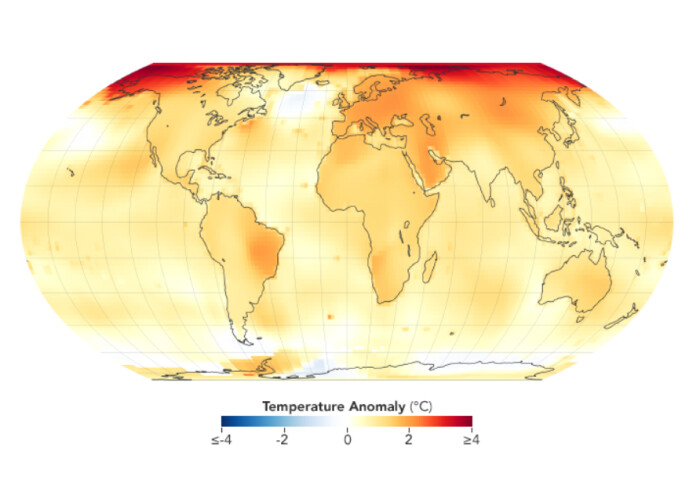

Carbon emissions have pushed the global temperature up by 1°C compared to pre-industrial levels, and continue to do so.

These environmental trends can lead to unexpected disasters that are extremely expensive to insurers. They benefit from using technology to anticipate changes and take advantage of the predictions.

For instance, the wildfires in Australia killed more than one billion animals and caused infrastructure damage estimated at $100 billion. Reports from Christian Aid make it clear the trend may lead to even more extreme wildfires.

Climate trends pose a real challenge to insurance companies; they must adapt to constantly changing conditions without implementing fees and premiums that might financially cripple their customers.

Deloitte’s report on the subject claims that advanced analytics can be the key to correctly assessing historical weather records, insured property data, and predictions of future weather conditions. Insurtechs can utilize this data to improve risk selection and assessment, and to change their pricing accordingly.

When combined with the Internet of Things, Artificial Intelligence can help scientific institutions better track global weather patterns and predict disasters.

Looking to build your insurance software project?

We are ready to apply our top-notch expertise to deliver the best-performing insurance software solution.

Julia Tuskal

Head of Sales

at HQSoftware

Risk tolerance calculation

For insurance companies, risk tolerance is at the core of their business activity. Risk tolerance, or risk appetite, refers to the risk the insurer is willing to take to successfully carry out its operations.

Managing risks is the key to staying profitable and competitive, and it requires a strong in-house workflow organization. Sudden disasters, financial losses, or unexpected regulatory constraints can lead to the insurer not being able to deliver on its policies.

Artificial Intelligence technology can help insurers avoid that scenario by improving their risk assessment processes and offering better policies to their clients. Sophisticated statistical models can help determine how to allocate risk, and help the company understand the risk-premium balance.

Advanced risk assesment will help insurers reduce costs and offer better policies to customers.

Thanks to emerging access to external data sources, such as historical data and IoT sensors and devices, insurers will be able to create extremely personalized risk scores. This way, a company can offer premiums based on actual behavior rather than a generalized risk profile, which is based on certain categories such as age and gender.

Fraud detection

In the UK alone, insurance providers lose about £1.2 billion yearly due to fraud. To compensate, they have to raise premiums by 5%. There will always be people who try to profit from fraudulent claims, but what can companies do to protect themselves?

Artificial Intelligence can help identify fraudulent behavior in several ways. Some tools can be used to track data from social media such as Facebook and Twitter and gather contradicting evidence. The insurance software companies develop algorithms that churn through large volumes of information on insurance claims, facilities and specialists involved, locations, and so on, to detect suspicious behavior.

AI analyzes the data from various sources to identify fraudulent behavior.

Insurance companies can benefit from AI when assessing damage as well. Technology can be used to estimate the cost of repairing a damaged car from uploaded photos. This way, the insurer gets real-time efficient estimates, while clients are guaranteed fair compensation, eliminating the chance of a client profiting from an insurance claim.

Consistent optimization of customer investments and insurance coverage

Complex AI algorithms are a great way to hone the products insurance providers offer. Coupled with behavioral analysis, AI can review policies offered to customers and point out details that can be tweaked to better suit customers’ needs while using the insurer’s resources more effectively.

Marketing

Artificial Intelligence can also be utilized to explore potential markets. It allows Insurance providers to analyze data from social media and other open sources of data to pinpoint customer needs that are specific to a particular market. Based on that data, insurers may create policies that more specifically serve those customers.

AI can also be applied to social media management. Whether that means introducing chatbots or employing advanced user engagement analytics, this allows for a more sophisticated strategy to reach more potential customers, solve their issues, and expand the business.

Customer service

Apart from assessing risk correctly, insurance companies can apply Artificial Intelligence to other aspects of client-provider relations:

Artificial Intelligence allows for personalizing customer experience and improving their satisfaction.

- Automated research. By shrinking research time, an AI-assisted customer service platform can generate quicker responses and offer better insights into customers’ needs. By anticipating those needs, insurance companies will be able to offer better products and increase customer satisfaction and retention.

- Behavior analysis. Technology can be used for behavior analysis to find out if the customer is about to cancel his or her insurance policy. In this situation, the insurer may offer additional features, suggest switching to a better-fitting policy, offer personalized discounts, and so on.

- Chatbots. Another way of implementing advanced technology in customer service is chatbots. Those can be integrated both as proprietary messaging services within the insurance provider’s website and outside services such as Facebook Messenger, Telegram, or WhatsApp.Thanks to natural language processing, chatbots can understand users without requiring that requests be typed in a specific way. Bots are better at offering real-time support such as FAQs, blog posts, and reports, and far quicker at researching customer complaints.If the customer’s issue becomes complicated, an AI-assisted support system is able to channel it through parallel support channels. For instance, if the call-center agent can’t resolve a technical issue, the customer will be guided to a technical support team that is more competent at those types of problems.

AI Trends in insurance of 2020

As we can see, AI has many potential applications for the insurance business. Each promises to be beneficial for the business and workflow efficiency. But when it comes to recent trends, here’s what is most favored by AI adopters.

Behavioral Premium Pricing

With the help of Artificial Intelligence, insurance companies are now able to make predictions based on real events in real time. Those predictions are based on large datasets rather than samples, to be most accurate.

In addition, insurance companies can use data gathered from all sorts of IoT devices to obtain data from real people in real time, instead of generalized groups, which also makes for the most correct assessment.

Such analysis allows for a “pay what you risk” approach: this way, the risk is personalized and premiums can be lowered for individual customers who present lower risks.

Customer Experience & Coverage Personalization

Personalization of the customer experience can be achieved through chatbots and flexible pricing.

Some insurtechs go even further — now, it is possible to buy life insurance with a selfie. The system scans the customer’s face and can predict if he is a smoker, for example. From there, the system can offer suitable life insurance coverage.

AI offers a way to get insurance with no hustle.

Another example of personalization is Allianz1, a web interface from an Italian insurance company that allows a kind of “build your own insurance plan” process. The customer can match business lines to create the best-fitting coverage.

Customized Claims Settlement

AI-assisted systems are able to review claims much faster than humans, eliminating errors and increasing the number of claims processed over time. The technology can go through tons of documents and crunch the numbers in a matter of minutes. Above all, this leads to higher customer satisfaction rates and can potentially bring new clients in.

AI also scans the data for contradicting evidence to prevent fraud and protect the insurer’s assets.

Bottom Line

It is important to keep in mind that insurance is a large and complex industry. Despite all the perks and advantages businesses can get from Artificial Intelligence, they still often find it hard to implement into their products and backend systems.

But with the world bringing new challenges every day, we could see the trend toward adopting these technologies speed up. For instance, the challenges presented by the COVID-19 pandemic have drawn the increasing attention of insurance companies to Artificial Intelligence as a way to stay efficient while cutting costs, reducing risks, and generating customer insights.

HQSoftware Founder

Having founded the company in 2001, uses his broad knowledge to drive the company forward. Ready to share his wisdom on software development and technology insights

Related Posts

View All

We are open to seeing your business needs and determining the best solution. Complete this form, and receive a free personalized proposal from your dedicated manager.

Sergei Vardomatski

Founder